According to the University of Massachusetts School of Public Health and Health Sciences, more than 70% of the US residents participated in gambling in 2022. This encompasses a wide range of gambling activities, including lotteries, raffles, blackjack, and sports betting.

Gambling is sanctioned by various levels of government, particularly the state and local authorities, which are guaranteed to generate revenue from its expansion. As well as cultural organizations, for instance, the NFL actively supports this trend. As the next NFL season approaches, sports betting reaches its peak. In 2022, a new record for commercial gaming was set with revenues reaching $60 billion.

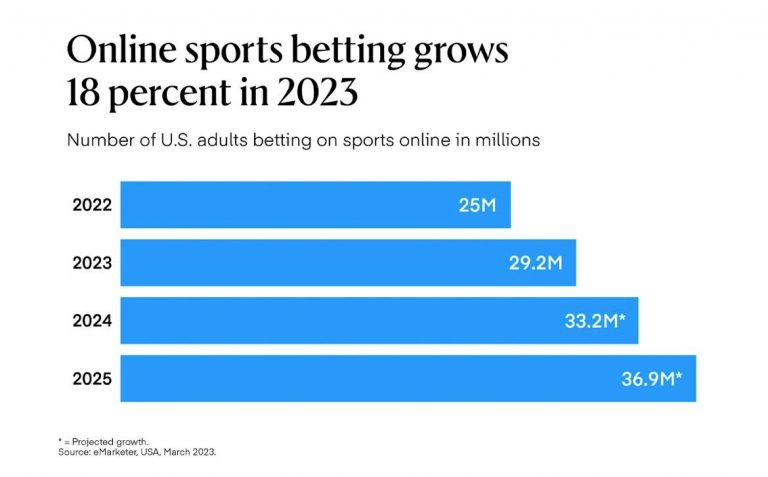

Today, nearly 30 million Americans engage in gambling, compared to only 10 million in 2019. However, the actual figures may be even higher, as the allure of gambling continues to attract new participants.

The gambling industry is becoming increasingly attractive to investment companies.

How it happened

Recognizing this trend, the HraiGamble Group has meticulously compiled expert opinions and analytical reports to shed light on the intricacies of this expanding field.

A multitude of factors has contributed to this widespread phenomenon.

Firstly, the Supreme landmark decision in May 2018 struck down the Professional and Amateur Sports Protection Act (PASPA), which had effectively banned sports betting since 1992. This ruling paved the way for individual states to legalize sports gambling, and 34 have done so to date.

Secondly, technological advancements have enabled more states to introduce online sports betting platforms. This has undoubtedly fueled the growth in participation and, of course, revenue.

As Vox analyst Dylan Scott aptly notes, “almost everyone now carries a mini-casino in their pocket”. “Want to bet on tonight’s NFL game? There’s an app for that”. The ubiquity of smartphones has made gambling accessible for Americans anytime, anywhere, for anything.

The combination of digital convenience and legal sanctioning has significantly accelerated involvement of people in gambling.

Thirdly, the political arena has also played a pivotal role in promoting the gambling industry. Politicians often portray gambling as a positive force for local economies, emphasizing the growing gambling industry potential to generate tax revenues for public services and create new jobs all that without imposing tax hikes on voters.

Fourthly, the Covid-19 pandemic has contributed to the industry development particularly in the online gambling sector, as people sought alternatives during lockdowns and restrictions on physical betting.

Online gambling market size and forecasts

Consumers are spending billions of dollars on sports betting via digital platforms, and betting houses, media companies and other ecosystem participants are making a profit.

Prominent analysts are forecasting a promising future for the online sports betting industry. Here, we present the forecasts from a few of these experts.

IMARC Group predicts that the market value will reach $133.9 billion by 2028, with a CAGR of 8.5% in 2023-2028.

Research and Markers expects the market to continue its growth trajectory and reach $162.69 billion by 2030, at a CAGR of 10.66%.

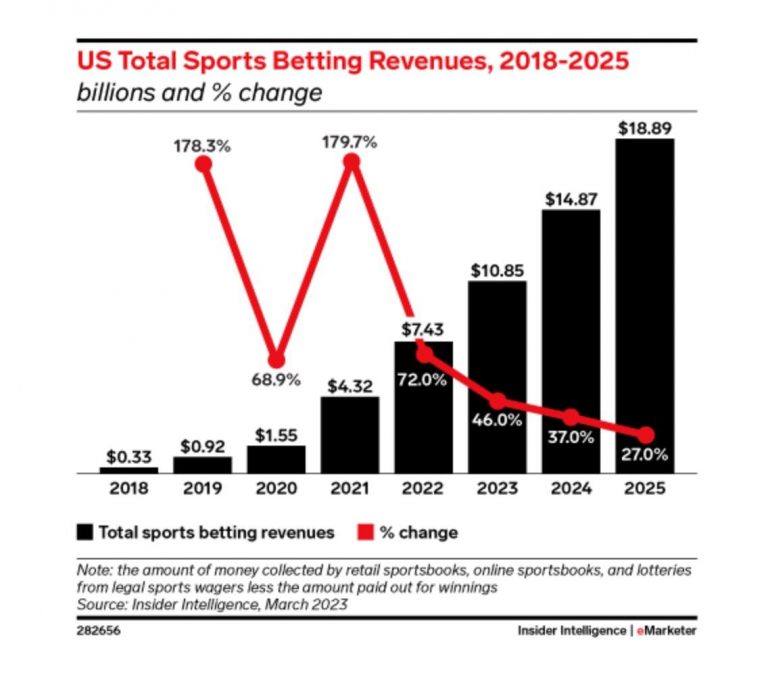

Regarding the online gambling market in the United States, according to insights from Insider Intelligence, this sector is poised to generate tens of billions in revenue, exhibiting double-digit percentage growth each year, at least until 2025.

The eMarketer study dated March 2023 demonstrates that nearly 40 million Americans plan to bet on sports online by 2025. And by the end of 2023, nearly 30 million adults in the United States, or 11% of the adult population, are expected to place bets through online bookmakers.

At present, gambling holds legal recognition in 34 states along with the District of Columbia. It is worth noting that the three most populous states namely California, Texas and Floridas have yet to fully embrace sports gambling due t0 a variety of reasons. However, these states are in the process of moving towards its legalization.

In California, there was a ballot initiative to legalize sports gambling, but it failed in November 2022, and no new legislation is currently in the works. In Texas, the prospects for legislation are also uncertain right now, and this is mostly for political considerations, as there is a divided state government. And Florida has technically legalized sports betting, but it has yet to be launched due to some legal challenges that are likely to hold it up in the courts for some time. Nevertheless, once these states overcome their respective hurdles, the legalization of sports betting is expected to usher in a significant transformation.

In the current year, sports betting service providers are projected to generate nearly $11 billion in revenue, as stated by Paul Vern from Insider Intelligence. This substantial figure is accompanied by a staggering total amount wagered by bettors, surpassing $136 billion, highlighting the substantial investment appeal of the industry.

To grasp the growth dynamics, let’s contrast these figures with the sports betting revenues of 2020, which stood at $1.5 billion. In just a few short years, we’ve witnessed a remarkable surge, with revenues skyrocketing to a remarkable $11 billion.

Gaming companies stocks are on the rise

What companies are the drivers of this boost?

FanDuel and DraftKings currently dominate the US market with 46% and approximately 25% market share, respectively, solidifying their positions as the two industry giants. Other notable players include BetMGM, commanding a 12% share, Caesars Entertainment at 6.7%, and various smaller operators in the market. Furthermore, Penn Entertainment and Fanatics are emerging as promising contenders with significant growth potential.

Investment firms are directing their focus toward the online gambling market with growing interest. Investors are recognizing online sports betting as an industry harboring substantial untapped profit potential, buoyed by attractive growth prospects. This optimism is further fueled by an evolving environment that emphasizes improved operating cost control across the industry

For example, investment consultant ARK Invest has been trading shares of major players such as DraftKings on exchange-traded funds for several years. By the way, in September 2023, the firm earned about $46.66 million on the sale of DraftKings (DKNG) shares based on different closing prices during the month.

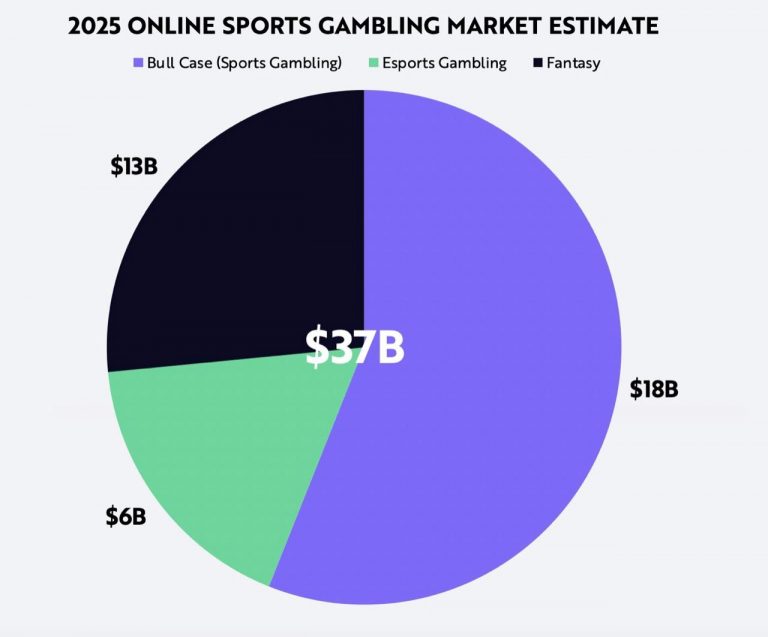

Back in 2020, during the pandemic, ARK Invest predicted a rapid growth trajectory for online gambling, rising 10-fold from around USD 18 billion to USD 180 billion. The three main categories of sports betting could then lead to a 31% CAGR in revenue growth, taking the online sports betting category to $37 billion in 2025.

Source: ARK Investment Management LLC, data sourced from FSGA.org, LegalSportsReport.com, G-Mnews.com

Stock analysts believe DraftKings has a “strong moat” that should allow it to compete with new names such as ESPN Bet, owned by PENN Entertainment (PENN) and Fanatics, similar to how it competed with Caesars (CZR).

However, the most significant competitor of DraftKings will be FanDuel if it goes to a US IPO. FanDuel parent Flutter Entertainment announced its intention, namely the possibility to hold a listing on the US stock exchange, after a successful Super Bowl.

Since the beginning of the year, the quotations of DraftKings (NASDAQ: DKNG) have risen from around $11 to a high of $34. Currently priced at $27.23, this is still one of the best online gaming deals of the year. Overall, DKNG shares are up nearly 155% in 2023.

As for Penn Entertainment’s (NASDAQ:PENN) potential, it’s been on a slow decline for most of the year, but is now on the up with strong earnings news and the Nov. 14 launch of ESPN BET, a sports platform with a mobile app.

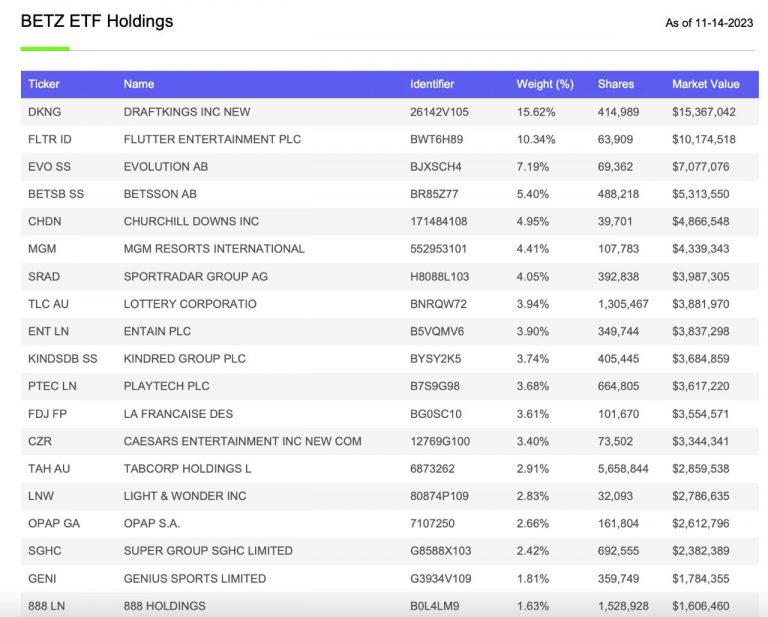

When seeking to diversify your portfolio with top-performing gambling stocks, there’s always an ETF like the Roundhill Sports Betting & iGaming ETF (NYSEARCA: BETZ).

Source: roundhillinvestments.com

Promotion, Politics and responsibility

DraftKings, one of the largest players in the world, invested at least $50 million to become the main sponsor of The Dan Le Batard Show with Stugotz, a most popular sports podcast in the world. Penn Entertainment recently signed a $2 billion deal with Disney-owned ESPN to rebrand its sports platform as ESPN Bet, with a mobile app, website and retail stores on the horizon. Fanatics paid more than USD 200 million for the assets of PointsBet (Australia).

They are committing substantial investments, totaling billions of dollars, to execute their marketing strategies with a clear objective in mind: expanding the allure of sports betting and enticing a larger pool of participants into the game.

According to the BIA Advisory Services forecasts, the national advertising spending is set to reach approximately $1.8 billion by the end of 2023. This trend presents a two-fold scenario: challenge and opportunity. On the one hand, it’s a golden opportunity for local markets to reap the rewards of identifying and securing local advertising revenue. Yet, on the other hand, it raises concerns about the increased risk of gambling addiction among the general population.

The national advertising spending is set to reach approximately $1.8 billion by the end of 2023.

Furthermore, an increasing number of influential opinion leaders have joined the marketing campaigns, including prominent NFL and NHL players. Such celebrity endorsements are adding substantial momentum to the industry growth.

In contrast, the markets like Germany and the UK have adopted a more mature approach to sports betting. They have implemented bans or restrictions on gambling sponsorship and advertising. For instance, the English Premier League is set to phase out gambling sponsors from team shirts by the end of the 2025-26 season.

Nonetheless, the landscape in the United States reveals a stark contrast. Astonishingly, the US invests a mere $1 per capita in gambling treatment for every $320 spent on substance abuse treatment. This striking disparity underscores the inadequate investment in addressing gambling-related issues.

So, why is this discrepancy persisting? It ultimately boils down to a financial tug-of-war. With a growing number of individuals engaging in gambling, both state and federal governments are reaping substantial financial benefits. Acknowledging and assuming responsibility for the growing problem would necessitate significant investments and a concession that their economic calculus may have veered off course.

Governments find themselves in a precarious balancing act. They must weigh an individual’s right to spend his money as he chooses against the responsibility to mitigate the associated harms. Currently, in the US, the scales seem tipped in favor of individual freedom, with the responsibility side often overlooked, primarily due to limited financial incentives for change.

Consequently, the matter of responsibility in the realm of sports betting remains an enduring challenge, with no straightforward solution in sight. The journey towards striking a balance between profits and the well-being of the public continues.