Pragmatic Play: We guarantee that 2024 will be even bigger. Interview

Interview with Pragmatic Play

HraiGamble Group talks with Anastasios Ioannidis, Affiliate manager at ARRISE powering Pragmatic Play.

1. How did 2024 begin for Pragmatic Play?

Pragmatic Play kicked off 2024 with a bonanza of new games, launching the likes of Blazing Wild Megaways™ and Loki’s Riches in January. The next month saw even more diverse and entertaining Slots added to the portfolio, with The Alter Ego, Big Bass Floats My Boat, Pompeii Megareels Megaways™, and Wheel O’ Gold among the highlights. Big Bass Day at the Races and Beware The Deep Megaways™ followed in March before the launch of Sugar Rush 1000, which is based on the multi-award-winning original Slot and includes even more mouthwatering multipliers, with players able to win up to 25,000x their bet. Pragmatic Play is producing up to eight new Slots every month that are designed for a range of audiences, from beginners and casual gamers to more experienced players.

2. Could you share your plans for 2024? What can we expect from the ambitious Pragmatic Play?

We’ve had a sneak peek at the first few releases of 2024, and we can say honestly that it’s going to be another exciting and packed year of top-quality across the portfolio. We see on average, 8 slot releases, plus Live Casino games coming out every month. If this pace is continued, we’ll see an incredible year to come. We’re not giving away anything just yet, but we guarantee that 2024 will be even bigger.

3. What new Slots from Pragmatic Play can we look forward to later in the year?

After the release of Sugar Rush 1000, players can look out for Fire Portals and The Dog House – Dog or Alive. Fire Portals is a unique 7×7 Slot that features a new wild roaming multiplier in both the base game and bonus game. The Dog House – Dog or Alive adds to another player-favourite Pragmatic Play game franchise, this time taking the lovable hounds on a classic Western adventure where wilds hit with random multipliers and the bonus round is triggered with a random number of free spins. Looking a little further ahead, Candy Blitz Bombs is also one to watch. Launching towards the end of April, this 6×5 reel Slot extends the sugary theme made popular by Pragmatic Play with games such as Sweet Bonanza and Sugar Rush. The new Slot features multiplier bombs ranging from 1x to 500x on consecutive tumble wins. And more games are being added to the hugely popular Big Bass series, with Big Bass Secrets of the Golden Lake and Big Bass Bonanza – Reel Action coming up next.

4. What have been some of the biggest wins in Pragmatic Play Slots to date? How often do players win big?

There are hundreds of games in Pragmatic Play’s Slots portfolio, which is available to players in markets around the world, so big wins are a frequent occurrence on this scale. And they don’t come much bigger than the 40,000x max win awarded in Power of Merlin Megaways™ last month – in this case, the player won an incredible €4,000,000! Following the launch of new dedicated Jackpot Play games earlier this year, we can expect Pragmatic Play titles to generate even more big wins, as players hit local progressive jackpots unique to each casino operator.

5. As a games supplier, you know better than anyone how the world of games develops. Could you tell us what types of games you think are gaining momentum?

Crash games and other non-traditional casino titles have been gaining in popularity for some time, but Slots continue to lead the way. Established themes, features, and mechanics are constantly being refined and reworked to build on what’s already popular and successful, so the momentum is still very much with Slots. That’s not to say non-traditional games and other product categories, such as Live Casino, aren’t becoming more and more popular, because they are – but Slots are a known quantity for players that still offer so much room for growth and imagination.

6. Pragmatic Play is known for its content expansion around the world. So, this year we have seen your successes in Latin America, Belgium, Austria, etc. Could you please share what challenges you faced along the way?

New markets are very exciting, it means we get to reach new audiences and get to delight even more players worldwide. One of the challenges of offering games to a variety of markets is that many of them come with their own regulatory requirements. For that reason, Pragmatic Play slots are meticulously designed to ensure that they comply with the key requirements of each regulated market. Player protection is the top priority, which goes hand-in-hand with a focus on creating a fun experience when it comes to developing games. From the conception of a new game to marketing, responsible gambling and player protection is at the forefront of development considerations.

7. HraiGamble Group for responsible and conscious gaming. What measures does Pragmatic Play take to ensure the safety of its players?

Player protection is the company’s top priority, and it is intricately linked to Pragmatic Play’s goal of creating a fun and enjoyable gaming experience. Responsible gaming and player protection is considered at every stage of the development process, from the conception of a new title all the way through to how it is marketed once released. As a globally prominent supplier, Pragmatic Play offers games in a variety of markets and jurisdictions, often each with its own regulatory requirements and rules. For that reason, titles are first and foremost created to comply with the key requirements of each market and given a lot of attention to ensure that it’s created with player protection top of mind.

46% of German men are involved into high-risk gambling 3 times more often than women: research

The German government has recently published the results of a Glücksspielatlas Deutschland 2023 and so, they enable us to estimate the number of gamblers, i.e. the share of women and men, and what are the gambling revenues for the government. To this end, experts from Casinospot.de, who provide unbiased reviews of the gambling market, scrupulously analyzed 169 pages of the study.

Glücksspielatlas Deutschland 2023 contains data from the current publications by experts from the Institute for Interdisciplinary Addiction and Drug Research (ISD Hamburg) and the Department of Gambling Research at the University of Bremen. The German Centre for Addiction Problems (DHS) is also listed as a co-publisher.

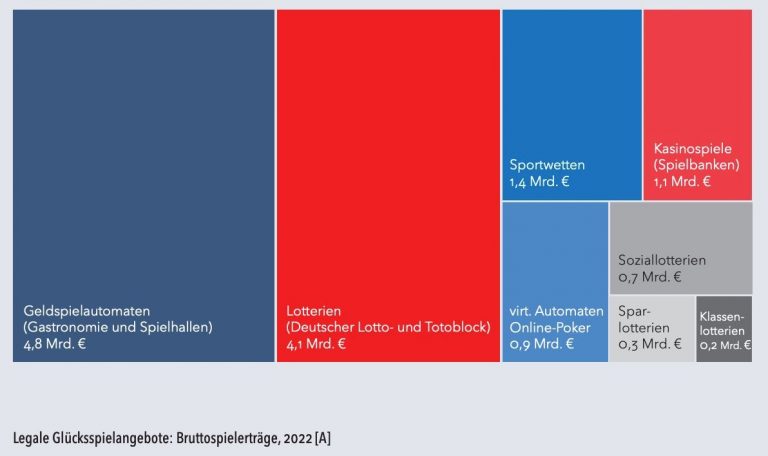

To better understand the development of this industry in Germany, let’s look at the financial indicators. In 2022, the gross revenue of the legal gambling industry was €13.4 billion. Revenues from illegal gambling, and here we are talking about the providers that have no German licenses but offer their services to German gamblers, cannot be taken into account because there is no official data in this respect.

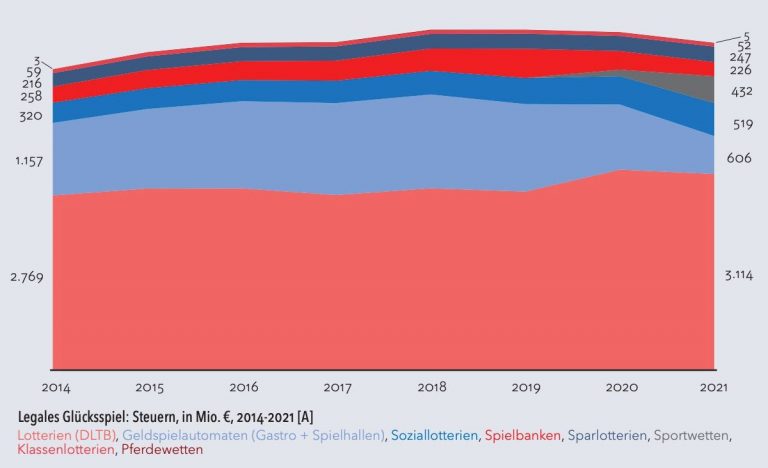

All licensed gambling providers in Germany have to pay taxes, and in 2022, the national budget earned 5.2 billion euros from this industry. By the way, since 2015, the gambling taxes have consistently exceeded 5 billion euros. Depending on the land, a part of the revenue goes to sports, culture, social and economic areas.

What kind of gambling do Germans prefer

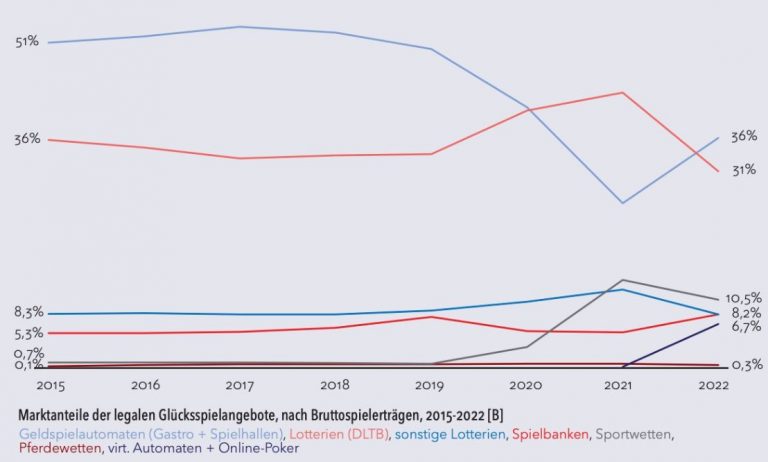

Based on the data published in the report, Germans are crazy about slot machines (36%) and various lotteries (39.2%), followed by sports betting (10.5%) and casinos (8.2%), and finally horse betting (0.3%) and, at last, virtual slots and online poker (0.1%). Please note that the data is provided only for the licensed gambling establishments.

So, now let’s look at the number of legal and illegal gambling providers.

In 2022, there were 17-18 legal casino companies, approximately 5000-6000 commercial slot machine operators, 16 operators of state lottery companies and 31 sports betting providers. In most cases, these are land-based gambling facilities.

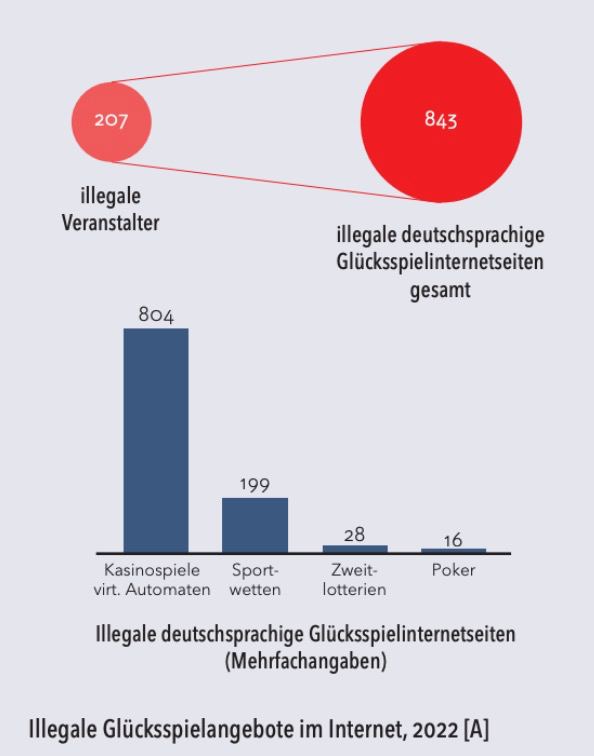

If we look at the data provided in the report dealing with the illegal gambling, we have the following statistics: there are 207 illegal organizers and 845 illegal German-speaking gambling sites on the market, offering online casino games, slot machines, sports betting, poker and non-state lotteries. So, we cannot calculate accurate data on participation in games offered in the online space. This leaves room for assumptions as to how many German players are going to these portals.

Differences in gambling behavior between men and women

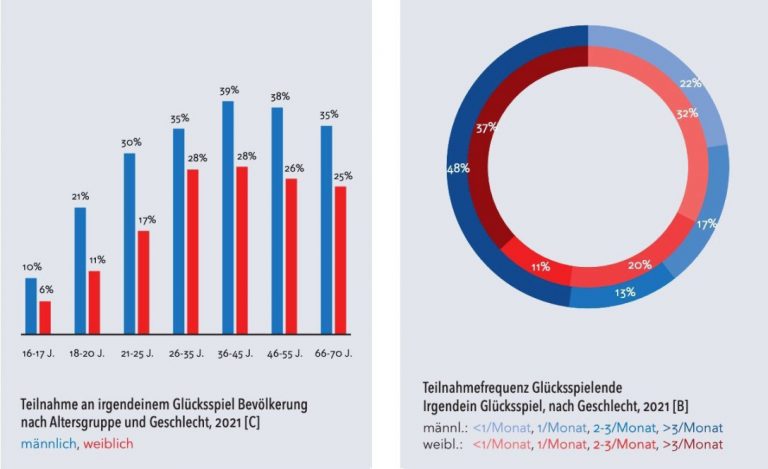

The largest age groups interested in gambling are 36-45 years old (34%), 46-55 years old (32%) and 26-35 years old (32%). The general trend of involvement shows that men are dominating in any age group.

People under the age of 25 participate in gambling much less, and the quantitative difference between male and female gambling is the largest in the age group of 21-25 (13%).

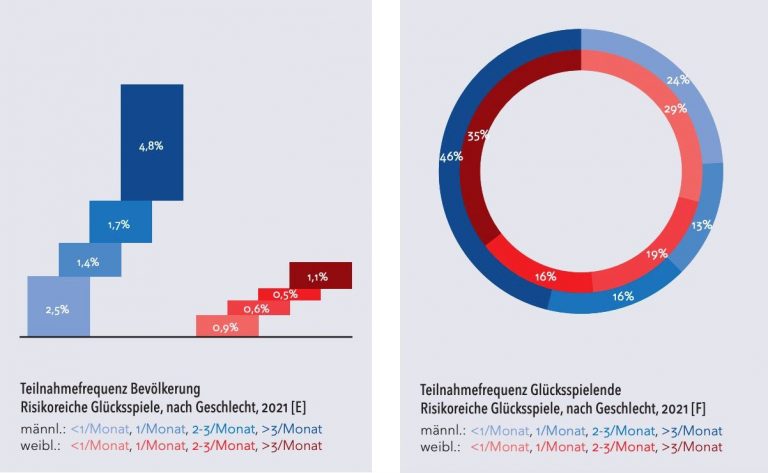

As it turns out, men gamble more often than women: 48% of men who gamble do so weekly or even daily. At the same time, when talking about women, this figure is 37%.

In addition, men’s interest in participating in high-risk gambling (casino, slot machines, sports betting) is more than 3 times higher and much more intense than women’s – 46% of them participate in such games at least weekly or even daily. For women, the corresponding share is 35%.

The overwhelming majority of German gamblers (68% of the total) choose only one type of gambling for their leisure time, with women outnumbering men by 7%. However, the share of the men who usually play three or more gambling formats exceeds 5%.

It turned out that women (44%) like to go to gambling establishments or restaurants with gambling halls more than men (38%). At the same time, more men (36%) than women (28%) participate in online games. Consequently, 25% of Germans, both men and women, combine online gambling with visiting land-based gambling facilities.

The authors of the study assert that the share of immigrants in gambling is significantly lower (24%) than among people who are not immigrants to this country (31%). But as we can see, the difference is not significant.

At the end of the day, we can make a conclusion that de-facto German men are more gamblers and tend to spend their time risking their finances more than women. However, please note that if we look at the quantitative parameters, the difference in gambling behavior by gender is quite small.

Gambling Atlas of Germany 2023: more than 5.2 billion in taxes annually vs. 1.3 million gambling addicts

the German government has recently published the results of a study dedicated to gambling. It is expected to provoke a new wave of initiatives to restrict advertising in various formats, as well as some other initiatives that promote gambling.

Glücksspielatlas Deutschland 2023 contains data from the current publications by experts from the Institute for Interdisciplinary Addiction and Drug Research (ISD Hamburg) and the Department of Gambling Research at the University of Bremen. The German Centre for Addiction Problems (DHS) is also listed as a co-publisher.

According to the said report, in 2022, Germany received 5.2 billion in taxes from gambling operators, and approximately 1.3 million adults suffer from a gambling disorder.

When presenting the report in Berlin, Burkhard Blinert, the Commissioner for Addictions and Drugs, stressed that the situation is really serious and called for a ban on TV gambling advertising before 23:00. Blinert hopes that the data and facts published in Glücksspielatlas Deutschland 2023 provide a good basis for discussing the right way to combat gambling and its consequences.

It is well known that gambling offers attract quick and sometimes big money wins. But hardly anyone knows how high the risk of addiction really is – from the first game onwards – even in politics.

Burkhard Blinert

The marketing company HraiGamble Group engaged experts from Casinospot.de, who provide unbiased reviews of the gambling market and carefully analyzed 169 pages of Glücksspielatlas Deutschland 2023. Their thorough examination provided valuable insights into behaviors of gamblers, external factors that influence their decision-making, industry turnover and profits, as well as the gambling revenues for the government. In this article we will provide some key points of the study.

Market size in terms of legal and illegal gambling in Germany

The gross revenue of the gambling industry, which means revenue after deducting distributed winnings, totalled €13.4 billion last year.

It is distributed as follows: the total cash from public lotteries collected €5.3 billion, the slot machine sector – €4.8 billion, and sports betting €1.4 billion, which is expected to grow significantly after the legalisation in 2020. Online poker also accounts for a small share of the total revenue – €0.9 billion.

Slot machines in restaurants and gambling halls, as well as public lotteries from German Lotto and Totoblock (DTLB), represented the largest share of permitted gambling in Germany for many years. 91% of the market share of public lotteries comes from sales at fixed points of sale and online sales. The remaining 9% comes from the mediation of commercial games on the Internet.

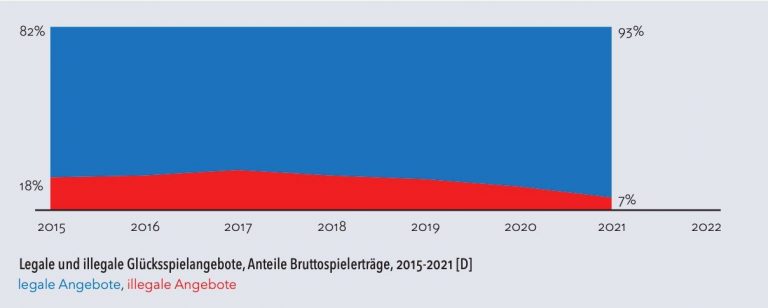

The illegal gambling industry in Germany mainly includes illegal casino games, virtual slot machine games, and sports betting. According to the Glücksspielatlas Deutschland 2023, the number of illegal games has been decreasing since 2017.

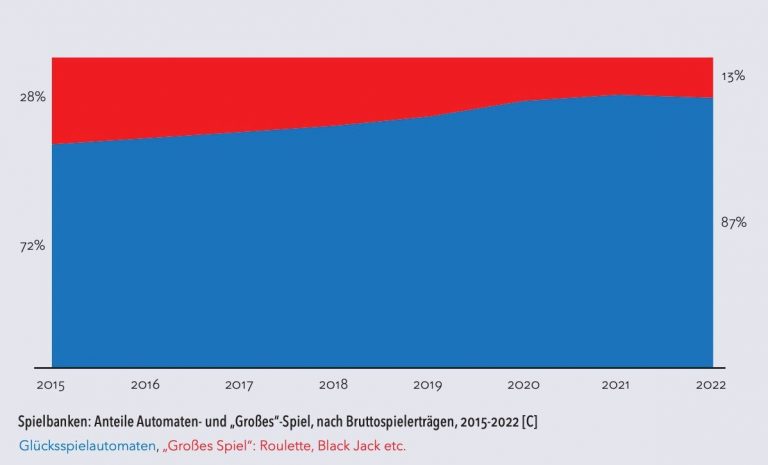

Looking at the chart below, it becomes clear that German players more and more prefer slot machines, while gradually abandoning the “big game” (like roulette, blackjack, etc.) – only 13% in 2022.

The gambling providers pay taxes depending on the gambling games they offer. This means that the government harvests several million euros annually from casino tax, lottery tax, sports gambling tax, entertainment tax, sales tax, totalisator tax, betting tax and other taxes. Depending on the land, there are certain reserves for parts of the revenue or for different beneficiaries, such as sports, culture, social and economic issues. According to the report, the state collected 5.2 billion euros in taxes from legal gambling last year.

This is how the shares are distributed by type of legal gambling.

As we can see, the largest share of revenues comes from public lotteries, followed by slot machines and sports betting, which was legalised in 2020. Please bear in mind that a large number of online gambling providers do not have any German license, so the state does not receive any profit from their business, although the operators offer their services in Germany.

Gambling advertising

Gambling providers have been the important advertising clients for private broadcasters for many years. TV is still the main advertising medium for gambling providers (68%), however, advertising has now moved beyond TV and into the online space through advertising on social media and other online channels. Streaming services such as Twich or Youtube broadcast videos where people participate in gambling or open a loot box. Sponsored streamers may have higher winning opportunities, which becomes an attractive factor among viewers.

In addition, public announcements of the luck of individual players who have won a jackpot or hit the jackpot in a casino serve as free advertising for gambling providers.

The involvement of influencers or renowned actors in advertising campaigns exerts a considerable influence on engagement of people in gambling activities. The endorsement of a contented and prosperous life by celebrities has become a significant concern, with multiple court cases already underway in the country challenging the legitimacy of such promotional campaigns.

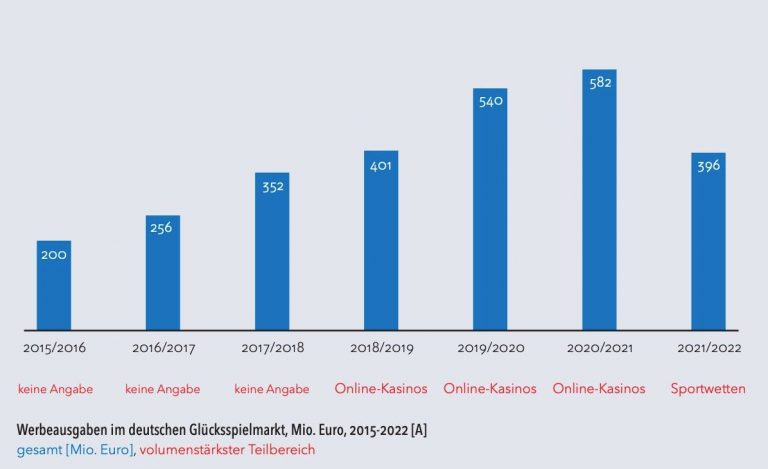

It turned out that the online casino sector has been the sub-industry with the highest advertising spend for several years, although it was only legal in Schleswig-Holstein until the State Gambling Agreement came into force in 2021.

Researchers estimate that over the past 4 years, spending on gambling advertising ranges from approximately €400 million to €600 million. For comparison, BIA Advisory Services forecasts that advertising spending in the US will reach approximately USD 1.8 billion by the end of 2023.

The authors of the study focus on sports betting advertising. In sports, sports betting providers, as well as lottery companies, act as generous sponsors of sporting events or sports clubs. In the 2022/2023 season, betting companies sponsored 17 out of 18 Bundesliga football teams. This is also consistent with the fact that sports betting advertising has become an important source of refinancing for sports reporting.

The prevalence of betting advertising in live sporting events and partnerships between major betting companies and football organisations have been highlighted as potential contributing factors to the problem.

According to Burkhard Blinert, every time a person searches for Bundesliga results on their smartphone, they are immediately confronted with offers from sports betting companies.

And especially when it comes to sports betting, stricter restrictions on advertising should be introduced as soon as possible. Sports betting simply needs to stop before, after and during sports coverage, even in the afternoon and early evening programmes.

Burkhard Blinert

According to the report, 30% of gamblers have placed bets in the last 12 months. In the US, according to the University of Massachusetts School of Public Health and Health Sciences, this figure is more than 70% of US residents participated in gambling in 2022.

Concerns about gambling addiction

Around 1.3 million people in Germany suffer from any form of gambling disorder. Another 3.3 million people have participated in risky gambling with early signs of addiction, the report says. By the way, the Gambling Commission has recently published a new study that shows that 1.3 million adults in the UK suffer from this problem as well.

Approximately one in thirteen gamblers experience health, financial or social problems because of going into slot machines, sports betting and other gambling.

Often, these issues become so common that families break apart, and lives of people are severely affected.

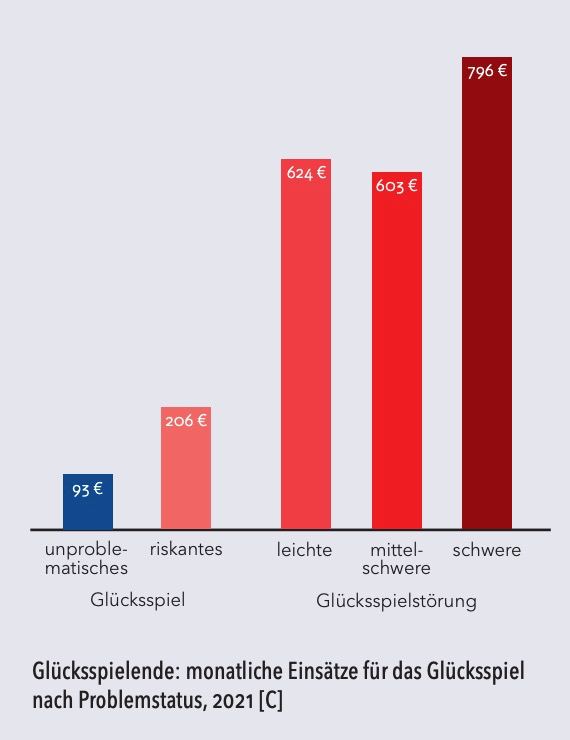

The money spent by individuals with gambling addictions varies considerably based on the specific nature of their addiction. The study presents a graph of the growth of money stakes, which, according to the authors, can be used to recognise when a harmless leisure activity turns into a dangerous addiction.

Players do not care to spend an average of 93 euros per month. If it is about an already risky gambler, the wasted cash will more than double to 206 euros. If the bets increase 3-4 times, which is approximately monthly bets of 603-769 euros, the player is assumed to have become addicted or as the one demonstrating a gambling disorder.

Concerns about gambling addiction

The online gambling industry is currently undergoing rapid growth, with industry experts projecting a substantial expansion over the next 5-8 years. The market is expected to continue its growth trajectory and will reach $162.69 billion by 2030, with a Compound Annual Growth Rate (CAGR) of 10.66%.

Considering the findings, Germany has all chances to consider new initiatives aimed at player protection, including stricter regulations on gambling advertising.

A complete ban on advertising will have a significant impact on the German gambling industry. It is because companies will no longer be able to promote their services via the traditional advertising channels. This will most likely entail a decrease in revenues for operators and, consequently, in taxes paid to the government. However, a positive impact would be that operators would be forced to look for alternative ways to present information about gambling, focusing on providing a safe environment for players. On the other hand, this trend could have adverse consequences, as players might increasingly resort to unlicensed or offshore operators in their pursuit of gambling, especially when the TV factor no longer serves as a clear indicator of the legality of such activities. In summary, the German gambling scene is at a crucial crossroads, navigating the delicate balance between financial gains and the pressing need to tackle escalating addiction concerns. Anticipated regulatory changes are poised to reshape the industry, necessitating adaptation and the adoption of responsible practices.

US’s Billion-Dollar Sports Betting: Profits, Politics and Liability

According to the University of Massachusetts School of Public Health and Health Sciences, more than 70% of the US residents participated in gambling in 2022. This encompasses a wide range of gambling activities, including lotteries, raffles, blackjack, and sports betting.

Gambling is sanctioned by various levels of government, particularly the state and local authorities, which are guaranteed to generate revenue from its expansion. As well as cultural organizations, for instance, the NFL actively supports this trend. As the next NFL season approaches, sports betting reaches its peak. In 2022, a new record for commercial gaming was set with revenues reaching $60 billion.

Today, nearly 30 million Americans engage in gambling, compared to only 10 million in 2019. However, the actual figures may be even higher, as the allure of gambling continues to attract new participants.

The gambling industry is becoming increasingly attractive to investment companies.

How it happened

Recognizing this trend, the HraiGamble Group has meticulously compiled expert opinions and analytical reports to shed light on the intricacies of this expanding field.

A multitude of factors has contributed to this widespread phenomenon.

Firstly, the Supreme landmark decision in May 2018 struck down the Professional and Amateur Sports Protection Act (PASPA), which had effectively banned sports betting since 1992. This ruling paved the way for individual states to legalize sports gambling, and 34 have done so to date.

Secondly, technological advancements have enabled more states to introduce online sports betting platforms. This has undoubtedly fueled the growth in participation and, of course, revenue.

As Vox analyst Dylan Scott aptly notes, “almost everyone now carries a mini-casino in their pocket”. “Want to bet on tonight’s NFL game? There’s an app for that”. The ubiquity of smartphones has made gambling accessible for Americans anytime, anywhere, for anything.

The combination of digital convenience and legal sanctioning has significantly accelerated involvement of people in gambling.

Thirdly, the political arena has also played a pivotal role in promoting the gambling industry. Politicians often portray gambling as a positive force for local economies, emphasizing the growing gambling industry potential to generate tax revenues for public services and create new jobs all that without imposing tax hikes on voters.

Fourthly, the Covid-19 pandemic has contributed to the industry development particularly in the online gambling sector, as people sought alternatives during lockdowns and restrictions on physical betting.

Online gambling market size and forecasts

Consumers are spending billions of dollars on sports betting via digital platforms, and betting houses, media companies and other ecosystem participants are making a profit.

Prominent analysts are forecasting a promising future for the online sports betting industry. Here, we present the forecasts from a few of these experts.

IMARC Group predicts that the market value will reach $133.9 billion by 2028, with a CAGR of 8.5% in 2023-2028.

Research and Markers expects the market to continue its growth trajectory and reach $162.69 billion by 2030, at a CAGR of 10.66%.

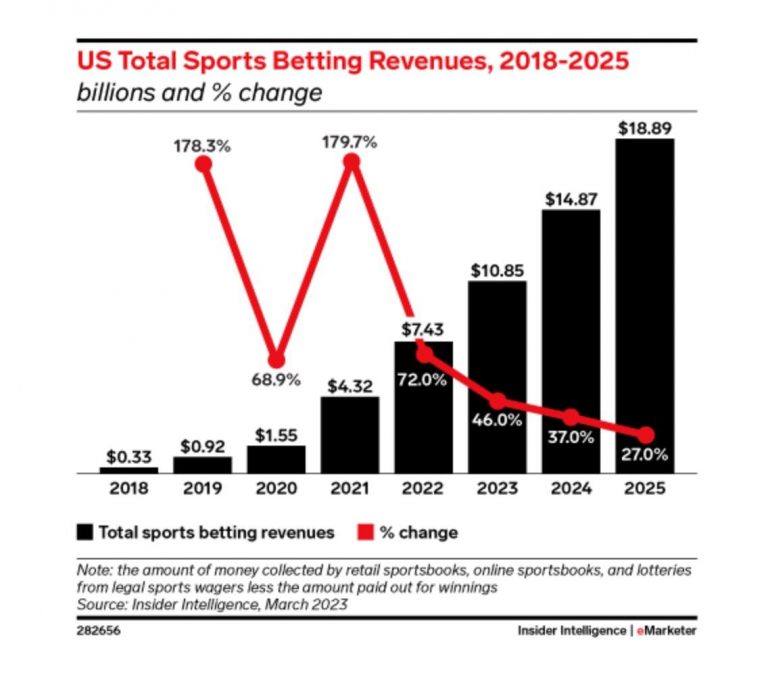

Regarding the online gambling market in the United States, according to insights from Insider Intelligence, this sector is poised to generate tens of billions in revenue, exhibiting double-digit percentage growth each year, at least until 2025.

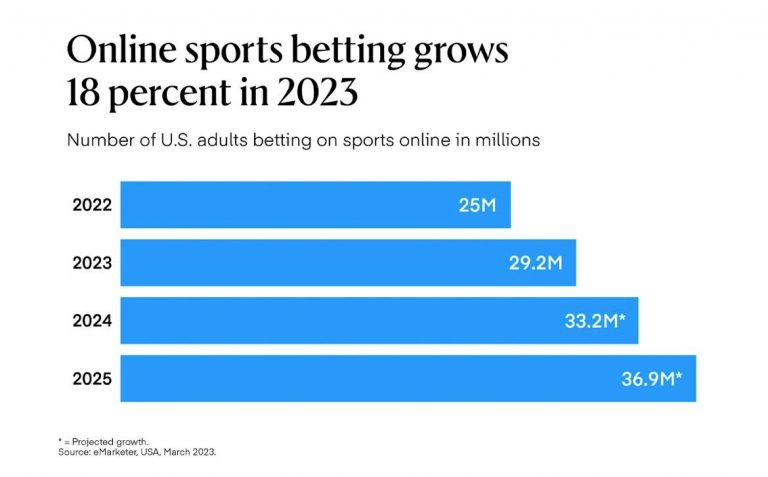

The eMarketer study dated March 2023 demonstrates that nearly 40 million Americans plan to bet on sports online by 2025. And by the end of 2023, nearly 30 million adults in the United States, or 11% of the adult population, are expected to place bets through online bookmakers.

At present, gambling holds legal recognition in 34 states along with the District of Columbia. It is worth noting that the three most populous states namely California, Texas and Floridas have yet to fully embrace sports gambling due t0 a variety of reasons. However, these states are in the process of moving towards its legalization.

In California, there was a ballot initiative to legalize sports gambling, but it failed in November 2022, and no new legislation is currently in the works. In Texas, the prospects for legislation are also uncertain right now, and this is mostly for political considerations, as there is a divided state government. And Florida has technically legalized sports betting, but it has yet to be launched due to some legal challenges that are likely to hold it up in the courts for some time. Nevertheless, once these states overcome their respective hurdles, the legalization of sports betting is expected to usher in a significant transformation.

In the current year, sports betting service providers are projected to generate nearly $11 billion in revenue, as stated by Paul Vern from Insider Intelligence. This substantial figure is accompanied by a staggering total amount wagered by bettors, surpassing $136 billion, highlighting the substantial investment appeal of the industry.

To grasp the growth dynamics, let’s contrast these figures with the sports betting revenues of 2020, which stood at $1.5 billion. In just a few short years, we’ve witnessed a remarkable surge, with revenues skyrocketing to a remarkable $11 billion.

Gaming companies stocks are on the rise

What companies are the drivers of this boost?

FanDuel and DraftKings currently dominate the US market with 46% and approximately 25% market share, respectively, solidifying their positions as the two industry giants. Other notable players include BetMGM, commanding a 12% share, Caesars Entertainment at 6.7%, and various smaller operators in the market. Furthermore, Penn Entertainment and Fanatics are emerging as promising contenders with significant growth potential.

Investment firms are directing their focus toward the online gambling market with growing interest. Investors are recognizing online sports betting as an industry harboring substantial untapped profit potential, buoyed by attractive growth prospects. This optimism is further fueled by an evolving environment that emphasizes improved operating cost control across the industry

For example, investment consultant ARK Invest has been trading shares of major players such as DraftKings on exchange-traded funds for several years. By the way, in September 2023, the firm earned about $46.66 million on the sale of DraftKings (DKNG) shares based on different closing prices during the month.

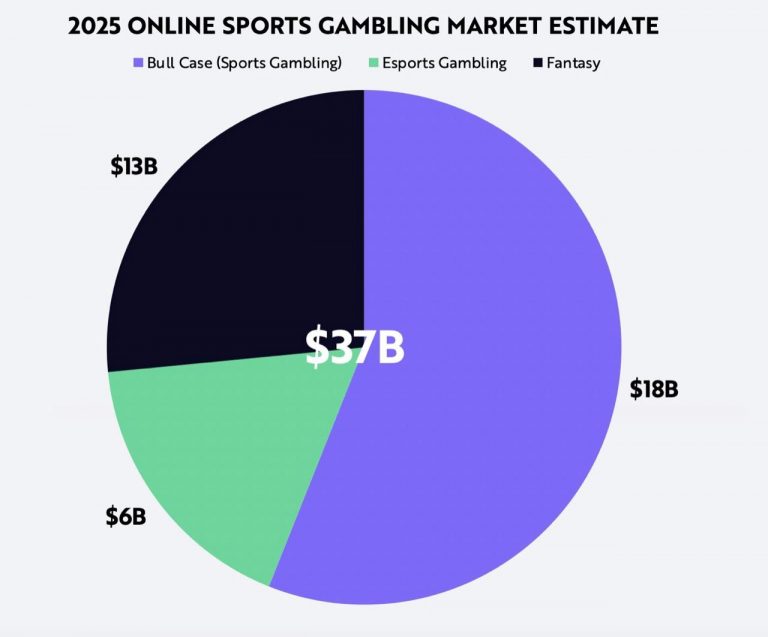

Back in 2020, during the pandemic, ARK Invest predicted a rapid growth trajectory for online gambling, rising 10-fold from around USD 18 billion to USD 180 billion. The three main categories of sports betting could then lead to a 31% CAGR in revenue growth, taking the online sports betting category to $37 billion in 2025.

Source: ARK Investment Management LLC, data sourced from FSGA.org, LegalSportsReport.com, G-Mnews.com

Stock analysts believe DraftKings has a “strong moat” that should allow it to compete with new names such as ESPN Bet, owned by PENN Entertainment (PENN) and Fanatics, similar to how it competed with Caesars (CZR).

However, the most significant competitor of DraftKings will be FanDuel if it goes to a US IPO. FanDuel parent Flutter Entertainment announced its intention, namely the possibility to hold a listing on the US stock exchange, after a successful Super Bowl.

Since the beginning of the year, the quotations of DraftKings (NASDAQ: DKNG) have risen from around $11 to a high of $34. Currently priced at $27.23, this is still one of the best online gaming deals of the year. Overall, DKNG shares are up nearly 155% in 2023.

As for Penn Entertainment’s (NASDAQ:PENN) potential, it’s been on a slow decline for most of the year, but is now on the up with strong earnings news and the Nov. 14 launch of ESPN BET, a sports platform with a mobile app.

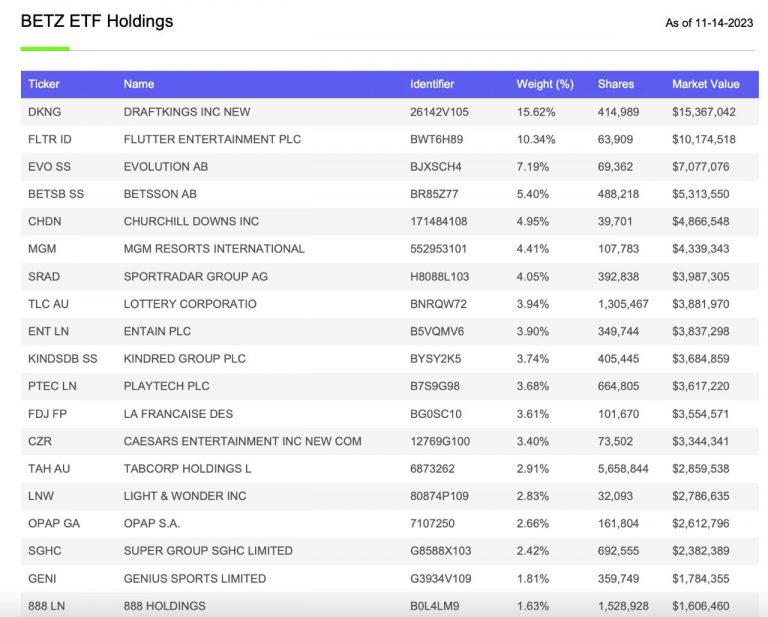

When seeking to diversify your portfolio with top-performing gambling stocks, there’s always an ETF like the Roundhill Sports Betting & iGaming ETF (NYSEARCA: BETZ).

Source: roundhillinvestments.com

Promotion, Politics and responsibility

DraftKings, one of the largest players in the world, invested at least $50 million to become the main sponsor of The Dan Le Batard Show with Stugotz, a most popular sports podcast in the world. Penn Entertainment recently signed a $2 billion deal with Disney-owned ESPN to rebrand its sports platform as ESPN Bet, with a mobile app, website and retail stores on the horizon. Fanatics paid more than USD 200 million for the assets of PointsBet (Australia).

They are committing substantial investments, totaling billions of dollars, to execute their marketing strategies with a clear objective in mind: expanding the allure of sports betting and enticing a larger pool of participants into the game.

According to the BIA Advisory Services forecasts, the national advertising spending is set to reach approximately $1.8 billion by the end of 2023. This trend presents a two-fold scenario: challenge and opportunity. On the one hand, it’s a golden opportunity for local markets to reap the rewards of identifying and securing local advertising revenue. Yet, on the other hand, it raises concerns about the increased risk of gambling addiction among the general population.

The national advertising spending is set to reach approximately $1.8 billion by the end of 2023.

Furthermore, an increasing number of influential opinion leaders have joined the marketing campaigns, including prominent NFL and NHL players. Such celebrity endorsements are adding substantial momentum to the industry growth.

In contrast, the markets like Germany and the UK have adopted a more mature approach to sports betting. They have implemented bans or restrictions on gambling sponsorship and advertising. For instance, the English Premier League is set to phase out gambling sponsors from team shirts by the end of the 2025-26 season.

Nonetheless, the landscape in the United States reveals a stark contrast. Astonishingly, the US invests a mere $1 per capita in gambling treatment for every $320 spent on substance abuse treatment. This striking disparity underscores the inadequate investment in addressing gambling-related issues.

So, why is this discrepancy persisting? It ultimately boils down to a financial tug-of-war. With a growing number of individuals engaging in gambling, both state and federal governments are reaping substantial financial benefits. Acknowledging and assuming responsibility for the growing problem would necessitate significant investments and a concession that their economic calculus may have veered off course.

Governments find themselves in a precarious balancing act. They must weigh an individual’s right to spend his money as he chooses against the responsibility to mitigate the associated harms. Currently, in the US, the scales seem tipped in favor of individual freedom, with the responsibility side often overlooked, primarily due to limited financial incentives for change.

Consequently, the matter of responsibility in the realm of sports betting remains an enduring challenge, with no straightforward solution in sight. The journey towards striking a balance between profits and the well-being of the public continues.

Save young people or kill the Dutch legal gambling market?

One of the goals of opening the online gambling market was that at least 80 % of players would play with a legal provider within three years of the market opening.

Contrasting Gambling Regulations in Germany and the UK – about the biggest markets in Europe

Europe has the largest global share of the online gambling market, accounting for more than 46% in 2022, according to the Online Gambling Global Market Report 2023 by Research and Markets.

In Denmark, the gambling industry underwent significant changes in 2012, transitioning from a state monopoly to liberalization.

The National Gambling Authority (ANJ) revealed that gambling turnover in France reached a record €12.9 billion in 2022, showing a significant 20% increase from the previous year.

Global online gambling market to grow by 10.7% by 2030 – forecast

The online gambling industry is currently undergoing rapid growth, with industry experts projecting a substantial expansion over the next 5-8 years. HraiGamble Group has examined key survey data to gain insights into the driving forces behind this growth.

HraiGamble Group has made its portals available for scientific and mathematical research of gambling

HraiGamble Group was involved into the scientific and mathematical research “The Reflection of the Mathematical Dimension of Gambling in iGaming Content: A Qualitative Analysis,” conducted by the prominent Dr. Catalin Barboianu.